ASPI and The Russell Effect

The Russell 2000 Index tracks the performance of about 2,000 small-cap U.S. stocks. It’s a key benchmark for small-cap mutual funds and ETFs, managed by FTSE Russell (Russell US Indexes | LSEG). As of December 31, 2024, the index had a weighted average market cap of $3.65 billion and a median of $0.99 billion (Russell 2000 Index – Wikipedia).

Each year there is an annual reconstitution of the Russell 2000 and it is a significant event, often leading to volatility as funds rebalance their portfolios. Funds tracking the Russell 2000 will buy or sell shares to align with the new weights, which could result in the “Russell Effect” for ASPI, with potential buying pressure due to its increased market cap and weight (Tap into Small-Cap Stocks Through the Russell 2000 Reconstitution – CME Group).

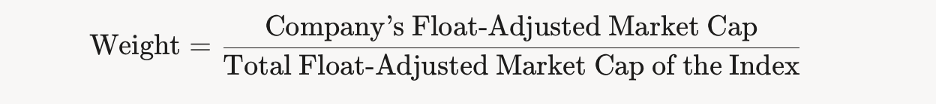

The Russell 2000’s market-cap-weighted nature means ASPI’s weight in the index rises with its market cap.

What This Means for Investors

ASPI’s ascent from a $3 stock with a $158 million market cap to $5.735 with a $421.6 million market cap underscores its growth momentum. This trajectory, fueled by advancements in isotope production and strategic initiatives, positions ASPI as an intriguing small-cap opportunity. The impending reconstitution could amplify this, as institutional buying enhances liquidity and visibility. Investors should monitor ASPI closely, especially as April 30, 2025, approaches, the cutoff for market cap rankings, since further price gains could boost its standing even more.

Weighting Methodology

The Russell 2000 is a market-capitalization-weighted index, meaning each company’s influence on the index’s performance is proportional to its float-adjusted market cap. This methodology ensures the index reflects the economic size of companies while accounting for shares available to public investors.

Larger companies within the index (e.g., those with market caps closer to $10 billion) have a greater impact on the index’s performance than smaller ones (e.g., those near $250 million). For example, a 10% price change in a company with a $10 billion market cap will affect the index more than a 10% change in a $500 million company (What Is the Russell 2000 Stock Market Index? | The Motley Fool).

- Sector weightings, as of March 31, 2024, show industrials as the highest weighted, followed by healthcare and financials, reflecting the index’s broad exposure (Russell 2000 Index Definition and Key Metrics – Investopedia).

- The index is rebalanced annually during reconstitution, which can lead to significant trading volume, known as the “Russell Effect,” as funds buy or sell shares to align with new weights (Tap into Small-Cap Stocks Through the Russell 2000 Reconstitution – CME Group).

Impact on Weighting:

- Since the Russell 2000 is market-cap-weighted, ASPI’s doubled market cap increases its weight in the index. For example, if its original weight was 0.01% (based on a $214 million market cap in a $30 billion total index market cap), its new weight could be approximately 0.02%, assuming other companies’ market caps remain constant. This higher weight means ASPI’s stock price movements will have a slightly greater impact on the index’s performance (What Is the Russell 2000 Stock Market Index? | The Motley Fool).

- The increased weight may attract more attention from institutional investors and index-tracking funds, potentially leading to buying pressure during the reconstitution period.

Reconstitution and Russell Effect:

- The annual reconstitution is a significant event, often leading to volatility as funds rebalance their portfolios. Funds tracking the Russell 2000 will buy or sell shares to align with the new weights, which could result in the “Russell Effect” for ASPI, with potential buying pressure due to its increased market cap and weight (Tap into Small-Cap Stocks Through the Russell 2000 Reconstitution – CME Group).

- Given the reconstitution dates (rank day April 30, 2025, effective June 27, 2025), and today being April 15, 2025, ASPI’s inclusion and weight will be confirmed soon, with adjustments likely to occur in late June.

Long-Term Implications:

- If ASPI’s market cap continues to grow significantly (e.g., approaching $5-10 billion), it could eventually move to the Russell 1000, which includes the top 1,000 companies by market cap. However, with a current market cap of $500 million, this is unlikely in the near term (Russell 2000 Stocks Index: Top List of Companies in 2025).

- The price increase may also enhance ASPI’s visibility among small-cap investors, potentially attracting more institutional interest, especially if its fundamentals (e.g., revenue, earnings) support the valuation growth.